Enjoy 10% off charging at all public Charge+ locations for 3 months.

Living in a condo with Charge+ chargers? Get 1 month of Nano-tier access for free.

Includes comprehensive protection, windscreen claims, and reliable claims support.

If you insure your Tesla with ECICS, you also receive complimentary Tesla fractional shares—stackable with Charge+ benefits. Want to find out more? Click here

(same mobile number linked)

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

ECICS will be transmitting the details of your Private Car Policy to LTA upon successful enrolment within 3 business days. Please contact our mainline if you require support to urgently submit to LTA for online road tax renewals. Alternative, you can proceed to LTA office with the Certificate of Insurance to physically renewal your road tax at LTA office. Our mainline number is +65 6206 5588 (Mon - Fri excluding Public Holiday, 8:30am - 6:00pm).

If you sell your private car, you may inform us to cancel your policy. You can submit the request at customerservice@ecics.com.sg or call our mainline at +65 6206 5588 (Mon - Fri excluding Public Holiday, 8:30am - 6:00pm). Your Private Car policy refund is calculated according to the cancellation clause in your policy wording subject to no claims made against your policy.

Here's how you can determine the effective date based on each situation:For New FDW:The policy's effective date should be the date your FDW arrives in Singapore. This ensures that insurance coverage begins when the FDW starts her employment duties upon arrival in the country.For Transferred FDW:The policy's effective date should be the day you wish to apply for the issuance of her work permit at MOM. This ensures that insurance coverage is in place when the FDW's work permit is processed and approved for transfer to your employment.For Renewal FDW:The policy's effective date should be one day after the current work permit's expiry date. This ensures that insurance coverage seamlessly continues without any gaps when renewing the FDW's work permit for continued employment.

It is advisable to make a claim on your own insurance policy. Making a claim against motorists from another country can turn out to be costly and time-consuming. If you are not at fault, your NCD will not be affected.

A No Claim Discount Protector protects your NCD on renewal and allows you to make a claim under your policy without affecting your NCD. Without it, your NCD will be reduced should a claim be made under your policy.

Enhanced MaidAssure is a comprehensive insurance plan for your Foreign Domestic Worker (FDW) that covers the following benefits:- Accidental Death or Permanent Disablement,- Hospital & Surgical Expenses,- Replacement/Re-hiring Expenses,- Wages & Levy Reimbursement,- Repatriation Expenses,- Insurance bond guarantee.For more information, please refer to the policy wording. Alternatively, feel free to call us at +65 6206 5588, WhatsApp us at +65 8956 5588, or email us at customerservice@ecics.com.sg.

Our policy covers you when you ride your motorcycle in West Malaysia, the Republic of Singapore and that part of Thailand within 80.5km of the border between Thailand and West Malaysia.

We have 3 plans to suit your needs. The Comprehensive plan covers loss or damage to your motorcycle, as well as third party liability for bodily injury and property damage.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

Yes, it is illegal to use a vehicle in Singapore without a valid insurance cover. At a minimum, you must have third-party insurance, which covers injury or damage caused to other people and their property.

All riders need to be named in the policy. Unnamed riders are not covered.

You will only need to report to the police under the following circumstances:Damage to Government vehicle or propertyAccident with a foreign registered vehicleA Hit and Run accidentVehicle is stolen or vandalisedVehicle caught fireAccident involving a Pedestrian, Cyclist or Personal Mobility Device (PMD) usersA Malaysian police report is required if the accident happened in Malaysia.

It is advisable to make a claim on your own insurance policy. Making a claim against motorists from another country can turn out to be costly and time-consuming. If you are not at fault, your NCD will not be affected.

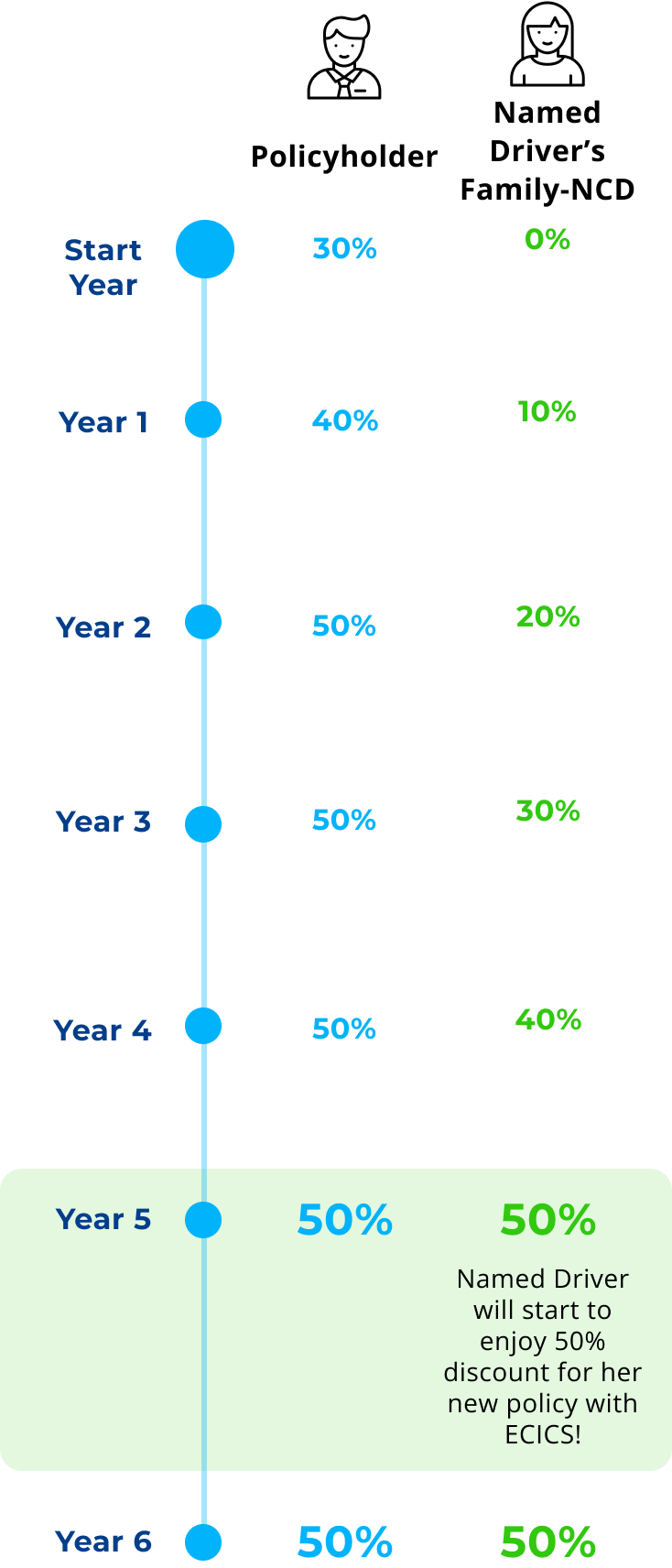

Just simply select our Comprehensive Family NCD Builder Plan during purchase and add your family members as named drivers.

A No Claim Discount Protector protects your NCD on renewal and allows you to make a claim under your policy without affecting your NCD. Without it, your NCD will be reduced should a claim be made under your policy.

Please declare all claims (excluding windscreen claims) made against your private car insurance during the past 3 years.