Enjoy 10% off charging at all public Charge+ locations for 3 months.

Living in a condo with Charge+ chargers? Get 1 month of Nano-tier access for free.

Includes comprehensive protection, windscreen claims, and reliable claims support.

If you insure your Tesla with ECICS, you also receive complimentary Tesla fractional shares—stackable with Charge+ benefits. Want to find out more? Click here

(same mobile number linked)

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

The 3- and 5-year plans are designed to offer greater value and convenience. By choosing a longer-term plan, you can: - Lock in your premium and avoid annual price increases - Enjoy discounted rates compared to yearly renewals - Reduce the hassle of renewing your policy every year It’s ideal for homeowners or long-term tenants looking for cost savings and peace of mind over a longer period.

You need to buy the Foreign Worker Bond before your new worker arrives in Singapore or before you can renew your existing worker's work permit.

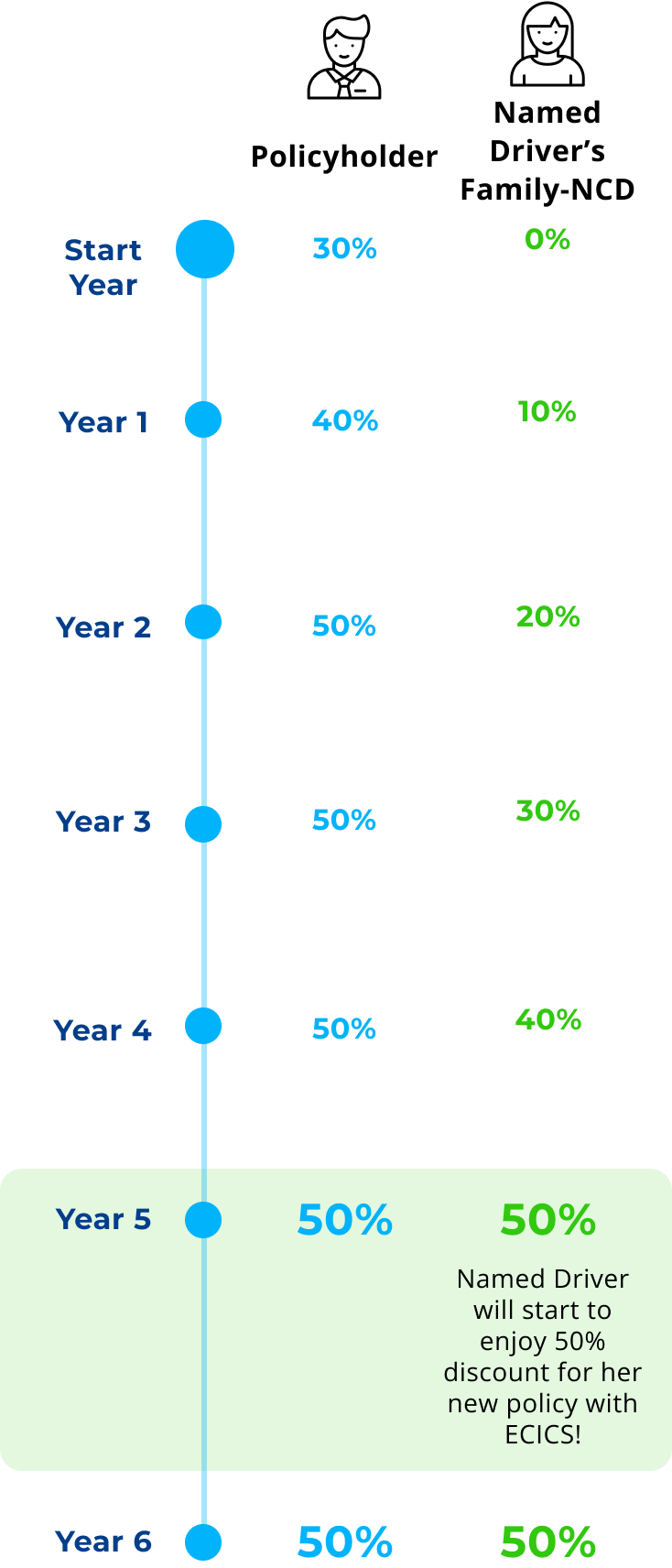

It is not transferrable to other insurers. This is a unique and innovative feature of our product to provide customers and their loved ones the best value they can get.

The premium of your car insurance policy is calculated based on the profiles of all the declared drivers including the named driver(s). Depending on the risk profiles of the drivers, the premium may remain the same, increase or decrease.

The deductible helps to prevent frequent claims and encourages responsible use of the policy. It also keeps the overall premium more affordable for all policyholders.

Certain amendments (e.g., typo error in name or passport number or change in effective date) can be made before the policy effective date. However, a re-transmission to MOM may be required depending on the type of amendment.

No, you do not need to pay $5,000 upfront to MOM as we act as a guarantor by issuing a Letter of Guarantee to MOM on your behalf. However, if you or your FDW breaches any of MOM’s rules or conditions, MOM may forfeit the bond and demand for payment from ECICS. In such cases, we will seek recovery of the amount from you.

Refund Policy (Upon Policy Termination):0 to 30 days in force – 80% refund of premium31 to 90 days in force – 50% refund of premium91 to 180 days in force – 30% refund of premium181 days and beyond – No refund100% of the premium will be refunded if:a) The Policy is cancelled within 90 days from the policy effective date and replaced with a new ECICS Enhanced MaidAssure policy; orb) The In-Principal Approval (IPA) is terminated and the FDW did not enter Singapore.Provided there shall be no refund if: • Any claim has been made or has arisen under the Policy; or • The premium refund is less than $27.25 (inclusive of GST). Please refer to General Conditions point 19 of the policy wording for the full cancellation terms and conditions.

Yes, we offer it as an optional add-on that covers outpatient medical expenses for illness that does not require hospitalisation. This benefit can cover up to $60 per visit, helping to ensure your FDW’s health needs are taken care of without added financial strain.

The coverage period for our Enhanced MaidAssure is 14 months or 26 months with the additional 2 months included as mandated by the Ministry of Manpower (MOM) in case the FDW overstays in Singapore after her work permit expires.

We do not cover usage for food, parcel or other delivery services.

With ECICS, all Private Motor Car insurance policy comes with a complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

Yes, so long as the driver has a valid driving license and fulfils our underwriting criteria as named driver, you can purchase this plan and add them as a named driver in the Comprehensive Family NCD Builder Plan.

Please repair your windscreen at an ECICS Authorised Workshop. Call the workshop of your choice and they will help you file your claim and advise you accordingly. Click HERE for a copy of the Windscreen claim form.If the windscreen claim is of criminal or vandalism-related, a police report must be made. A copy of the police report must be submitted to your choice ECICS Authorised Workshop.

Claim directly against the Third Party who is liable for the accident. You can bring your damaged car / motorcycle to any of our Authorised Workshops or your own preferred workshop who can assist you to file the Third Party claim; orClaim Own Damage claim under your policy if you have purchased a Comprehensive coverage. You will need to pay necessary Policy Excess (if any). The workshop will then assist you to recover against the Third Party’s insurer for the Excess paid.

Under the Motor Claims Framework (MCF), in any accident regardless how minor it was, it is a requirement that an accident report be lodged in any of our Approved Reporting Centres within 24 hours or by the next working day. Your insurer will do the necessary and review the matter upon receiving the signed Private Settlement form.