Enjoy a first-of-its-kind reward — receive Tesla fractional shares when you insure your Tesla with ECICS.

This exclusive benefit is made possible through our partnership with Phillip Securities Pte Ltd, a trusted name in investments.

Get comprehensive protection for your electric vehicle — including roadside assistance, accident repairs, and windscreen claims.

Transfer your NCD from other insurers and enjoy peace of mind with our round-the-clock claims support.

Discount is automatically applied. Not stackable with other promos. Click here to see Terms and conditions

(if you don’t have one)

(if you don’t have one)

A Foreign Worker Bond (commonly known as security bond) is a commitment to reimburse the government if either you or your foreign worker violates or fail to adhere to the terms and conditions of the work permit. This bond typically takes the form of a banker's or insurer's guarantee. For each non-Malaysian Work Permit holder you employ, you are required to purchase a $5,000 security bond.

Please notify our Claims Department within 21 days of the incident that gives rise to a claim. Our claims team will review and get in touch if clarification or further documentation is needed.Email: claims@ecics.com.sgClaim Form: Download Home Content Claim Form

You can report the accident at any of our Authorised workshop that is also our appointed Accident Reporting Centres within 24 hours of the accident.

Yes. The policy covers outpatient medical expenses (including TCM and Chiropractor treatments) incurred up to your plan limit for injuries due to an accident.

If you cancel your policy within 90 days, you’ll no longer be eligible for the benefit.

Enhanced MaidAssure is a comprehensive insurance plan for your Foreign Domestic Worker (FDW) that covers the following benefits:- Accidental Death or Permanent Disablement,- Hospital & Surgical Expenses,- Replacement/Re-hiring Expenses,- Wages & Levy Reimbursement,- Repatriation Expenses,- Insurance bond guarantee.For more information, please refer to the policy wording. Alternatively, feel free to call us at +65 6206 5588, WhatsApp us at +65 8956 5588, or email us at customerservice@ecics.com.sg.

Our policy covers you when you ride your motorcycle in West Malaysia, the Republic of Singapore and that part of Thailand within 80.5km of the border between Thailand and West Malaysia.

We have 3 plans to suit your needs. The Comprehensive plan covers loss or damage to your motorcycle, as well as third party liability for bodily injury and property damage.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

Yes, it is illegal to use a vehicle in Singapore without a valid insurance cover. At a minimum, you must have third-party insurance, which covers injury or damage caused to other people and their property.

All riders need to be named in the policy. Unnamed riders are not covered.

Excess, also known as the deductible, is the first amount of the claim that the policyholder needs to bear in view of the claim.

A No-Claim Discount (‘NCD’) is an entitlement given to you if no claim has been made under your policy for a year or more with the current/existing insurer. It reduces the premium you have to pay for the following year. This is your insurer's way of recognising and rewarding you for having been a careful driver. There is a standard followed by all insurers in setting the NCD, depending on your type of vehicle (private, commercial or motorcycle) and the period of insurance with no claim. The following table shows how the NCD is set by all insurers across the industry. Private Car Period of insurance with no claim Discount on renewal 1 year 10% 2 years 20% 3 years 30% 4 years 40% 5 years or longer 50% Motorcycle/Commercial Vehicle Period of insurance with no claim Discount on renewal 1 year 10% 2 years 15% 3 years or longer 20%

Yes, you can include as many named drivers as you want in your Private Motor Car insurance policy subject to underwriting and additional premium.

The driver involved in the accident must report personally, with a copy of the Driving License and NRIC, and the certificate of insurance to the Accident Reporting Centres. The vehicle must also be made available for photo-taking at the time of reporting.

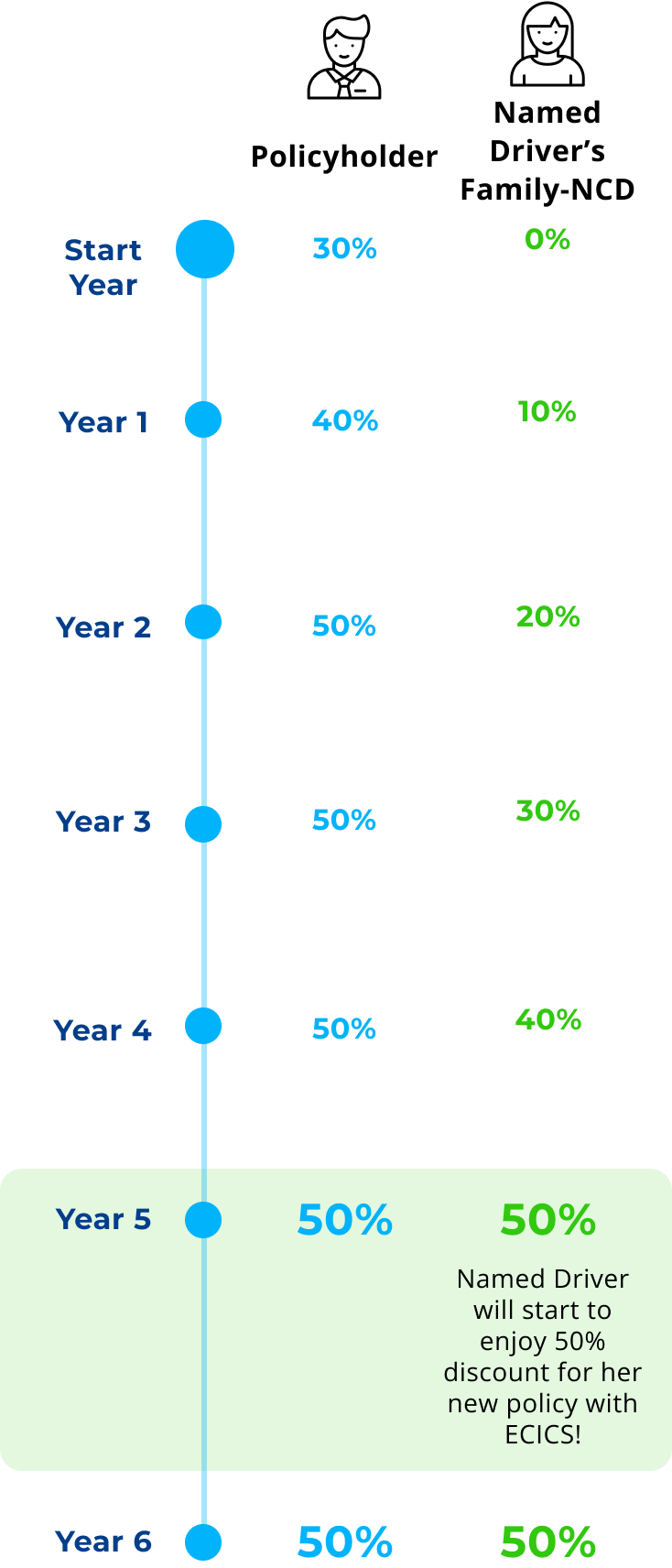

All earned Family-NCD will be reduced according to the GIA NCD framework (https://gia.org.sg/). However, with the Family NCD benefit still in place, it means all the Family NCD members can continue to earn 10% with each year of safe driving (max at 50%).