Enjoy a first-of-its-kind reward — receive Tesla fractional shares when you insure your Tesla with ECICS.

This exclusive benefit is made possible through our partnership with Phillip Securities Pte Ltd, a trusted name in investments.

Get comprehensive protection for your electric vehicle — including roadside assistance, accident repairs, and windscreen claims.

Transfer your NCD from other insurers and enjoy peace of mind with our round-the-clock claims support.

Discount is automatically applied. Not stackable with other promos. Click here to see Terms and conditions

(if you don’t have one)

(if you don’t have one)

Under the Motor Claims Framework (MCF), in any accident regardless how minor it was, it is a requirement that an accident report be lodged in any of our Approved Reporting Centres within 24 hours or by the next working day. Your insurer will do the necessary and review the matter upon receiving the signed Private Settlement form.

You can report the accident at any of our Authorised workshop that is also our appointed Accident Reporting Centres within 24 hours of the accident.

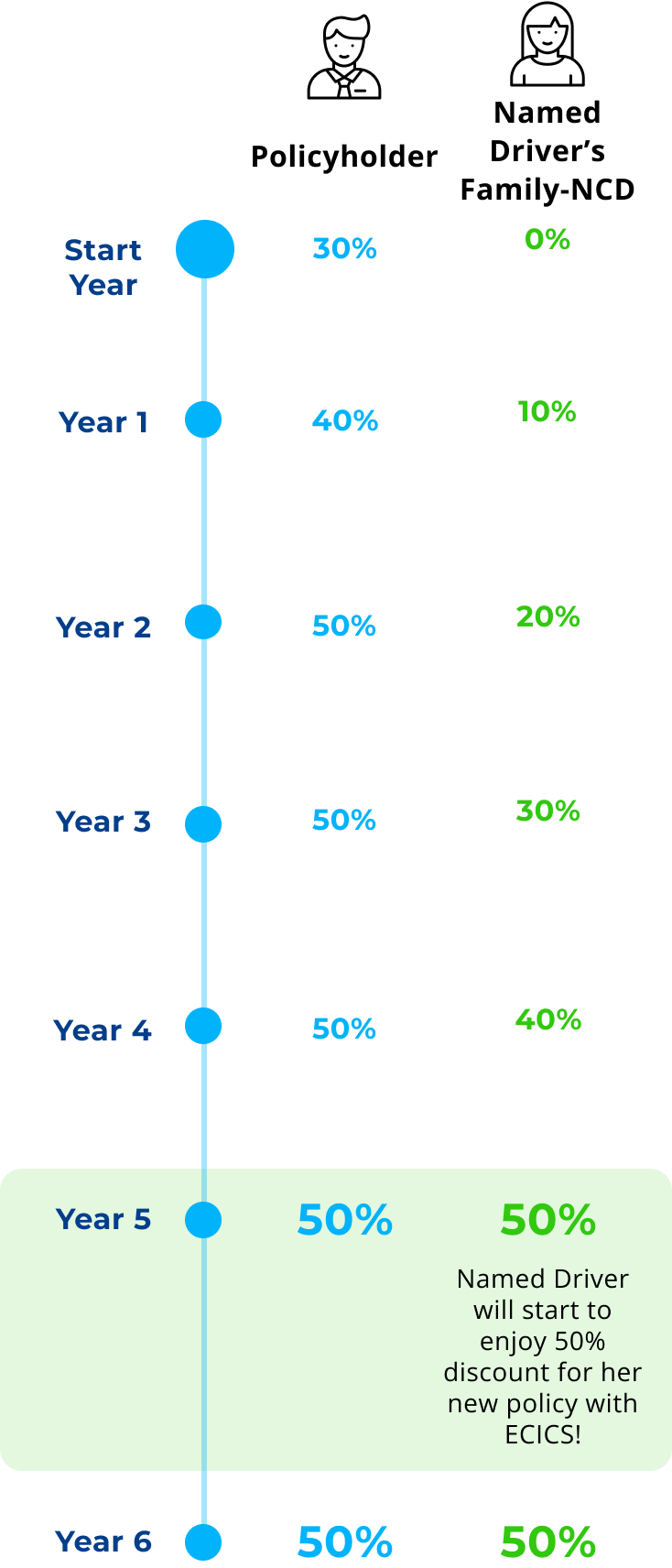

All earned Family-NCD will be reduced according to the GIA NCD framework (https://gia.org.sg/). However, with the Family NCD benefit still in place, it means all the Family NCD members can continue to earn 10% with each year of safe driving (max at 50%).

Yes, your motor insurance claims history over the past 3 years will be taken into account and may affect your premium when you apply.

No, you will not be double insured as long as the effective date of the new policy is one day after the expiry date of the current work permit. Purchasing the policy in advance helps ensure continuous coverage without any gaps. The new policy will only take effect from the selected effective date, not the date of purchase.

Enhanced MaidAssure is a comprehensive insurance plan for your Foreign Domestic Worker (FDW) that covers the following benefits:- Accidental Death or Permanent Disablement,- Hospital & Surgical Expenses,- Replacement/Re-hiring Expenses,- Wages & Levy Reimbursement,- Repatriation Expenses,- Insurance bond guarantee.For more information, please refer to the policy wording. Alternatively, feel free to call us at +65 6206 5588, WhatsApp us at +65 8956 5588, or email us at customerservice@ecics.com.sg.

We do not cover usage for food, parcel or other delivery services.

With ECICS, all Private Motor Car insurance policy comes with a complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

Yes, so long as the driver has a valid driving license and fulfils our underwriting criteria as named driver, you can purchase this plan and add them as a named driver in the Comprehensive Family NCD Builder Plan.

Please repair your windscreen at an ECICS Authorised Workshop. Call the workshop of your choice and they will help you file your claim and advise you accordingly. Click HERE for a copy of the Windscreen claim form.If the windscreen claim is of criminal or vandalism-related, a police report must be made. A copy of the police report must be submitted to your choice ECICS Authorised Workshop.

Claim directly against the Third Party who is liable for the accident. You can bring your damaged car / motorcycle to any of our Authorised Workshops or your own preferred workshop who can assist you to file the Third Party claim; orClaim Own Damage claim under your policy if you have purchased a Comprehensive coverage. You will need to pay necessary Policy Excess (if any). The workshop will then assist you to recover against the Third Party’s insurer for the Excess paid.

Under the Motor Claims Framework (MCF), in any accident regardless how minor it was, it is a requirement that an accident report be lodged in any of our Approved Reporting Centres within 24 hours or by the next working day. Your insurer will do the necessary and review the matter upon receiving the signed Private Settlement form.