Enjoy a first-of-its-kind reward — receive Tesla fractional shares when you insure your Tesla with ECICS.

This exclusive benefit is made possible through our partnership with Phillip Securities Pte Ltd, a trusted name in investments.

Get comprehensive protection for your electric vehicle — including roadside assistance, accident repairs, and windscreen claims.

Transfer your NCD from other insurers and enjoy peace of mind with our round-the-clock claims support.

Discount is automatically applied. Not stackable with other promos. Click here to see Terms and conditions

(if you don’t have one)

(if you don’t have one)

Contact us at +65 6206 5588 (Mon - Fri excluding Public Holiday, 8:30am - 6:00pm) or write to us at customerservice@ecics.com.sg.

The deductible helps to prevent frequent claims and encourages responsible use of the policy. It also keeps the overall premium more affordable for all policyholders.

Yes, our premiums are dependent on the Insured Person's occupation class. Class 1: Professionals/persons engaged in indoor & non-manual work in non-hazardous places. Examples: Accountant, Banker/Finance Officer, Lawyer, IT Professional, Teacher. Class 2: Professionals/persons engaged in work of an outdoor or supervisory nature or involved occasionally in manual work whose duties do not involve the use of tools or machinery or exposure to any special hazard. Examples: Property Agent, Sales Executive, Nurse, Chef, Physiotherapist. Class 3: Professionals/persons engaged in manual work, involving the use of tools or machinery but not of a particularly hazardous nature. Examples: Electrician, Car Mechanic, Commercial Driver, Gardener, Painter.

All riders need to be named in the policy. Unnamed riders are not covered.

It depends on the level of protection you want. Health insurance usually covers inpatient medical expenses for illnesses and injuries. Personal Accident insurance provides additional coverage for death or injury due to accident and includes outpatient medical expenses.

MOM will issue the discharge letter 1 week after the FDW has left Singapore. Please provide us with a copy of the discharge letter to proceed with your cancellation.Please note that the effective date of insurance cancellation will be determined based on the discharge date from MOM, not the date when the work permit is cancelled.

New and transfer maid policies purchased:• within 14 days before the effective date,MOM’s record will be updated within 3 working days after the policy purchase date• more than 14 days before effective date,MOM’s record will be updated within 14 days before policy start dateRenewal maid policy:• MOM’s record will be updated within 3 working days after the policy purchase date.Please check the MOM portal and ensure that the electronic transmission to MOM is completed before your FDW arrives in Singapore. Failure to do so will result in the Immigration and Checkpoints Authority denying her entry, and she will be sent back to her home country.

Yes, the policy will need to be cancelled, and a replacement policy issued.

The eligibility criteria states that the insured FDW must be between 23 and 60 years old at the time of application. This means that individuals outside of this age range may not qualify for coverage under the insurance policy.

You will need to cancel her work permit to stop your levy and ensure that you keep a copy of her travel ticket or departure itinerary as proof. MOM will proceed to discharge the Security Bond after verifying that your FDW has left and did not re-enter Singapore. Upon discharge, you may proceed to request for policy cancellation.

We do not cover usage for food, parcel or other delivery services.

With ECICS, all Private Motor Car insurance policy comes with a complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

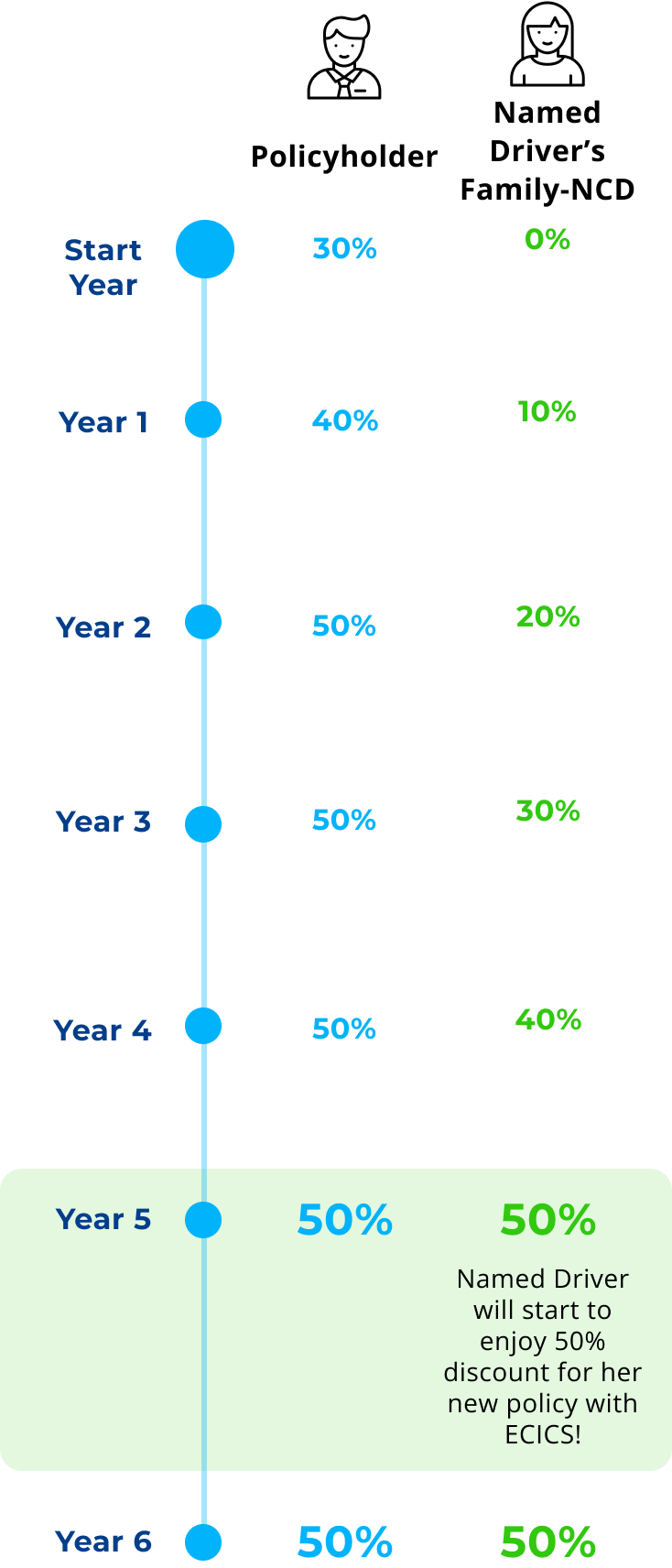

Yes, so long as the driver has a valid driving license and fulfils our underwriting criteria as named driver, you can purchase this plan and add them as a named driver in the Comprehensive Family NCD Builder Plan.

Please repair your windscreen at an ECICS Authorised Workshop. Call the workshop of your choice and they will help you file your claim and advise you accordingly. Click HERE for a copy of the Windscreen claim form.If the windscreen claim is of criminal or vandalism-related, a police report must be made. A copy of the police report must be submitted to your choice ECICS Authorised Workshop.

Claim directly against the Third Party who is liable for the accident. You can bring your damaged car / motorcycle to any of our Authorised Workshops or your own preferred workshop who can assist you to file the Third Party claim; orClaim Own Damage claim under your policy if you have purchased a Comprehensive coverage. You will need to pay necessary Policy Excess (if any). The workshop will then assist you to recover against the Third Party’s insurer for the Excess paid.

Under the Motor Claims Framework (MCF), in any accident regardless how minor it was, it is a requirement that an accident report be lodged in any of our Approved Reporting Centres within 24 hours or by the next working day. Your insurer will do the necessary and review the matter upon receiving the signed Private Settlement form.