Enjoy a first-of-its-kind reward — receive Tesla fractional shares when you insure your Tesla with ECICS.

This exclusive benefit is made possible through our partnership with Phillip Securities Pte Ltd, a trusted name in investments.

Get comprehensive protection for your electric vehicle — including roadside assistance, accident repairs, and windscreen claims.

Transfer your NCD from other insurers and enjoy peace of mind with our round-the-clock claims support.

Discount is automatically applied. Not stackable with other promos. Click here to see Terms and conditions

(if you don’t have one)

(if you don’t have one)

Most insurers in Singapore will allow you to keep your NCD should there be a break in vehicle ownership for up to 24 months. Some insurers set the timeframe at 12 months. You should contact your insurer for details.

Premiums vary depending on several factors, including the sum insured, the type of coverage, the excess amount on your primary policy, and your claims history. Each policy is unique, so premiums are tailored accordingly.

The deductible is the amount payable by you for each and every claim made against the policy.

Yes, you must have a POEMS account under the Policyholder's name to be eligible for the campaign.

For questions regarding the crediting of Tesla Fractional Shares, please contact Phillip Securities' Customer Experience Unit at 6351 1555 or talktophilip@philip.com.sg.

Certain amendments (e.g., typo error in name or passport number or change in effective date) can be made before the policy effective date. However, a re-transmission to MOM may be required depending on the type of amendment.

No, you do not need to pay $5,000 upfront to MOM as we act as a guarantor by issuing a Letter of Guarantee to MOM on your behalf. However, if you or your FDW breaches any of MOM’s rules or conditions, MOM may forfeit the bond and demand for payment from ECICS. In such cases, we will seek recovery of the amount from you.

Refund Policy (Upon Policy Termination):0 to 30 days in force – 80% refund of premium31 to 90 days in force – 50% refund of premium91 to 180 days in force – 30% refund of premium181 days and beyond – No refund100% of the premium will be refunded if:a) The Policy is cancelled within 90 days from the policy effective date and replaced with a new ECICS Enhanced MaidAssure policy; orb) The In-Principal Approval (IPA) is terminated and the FDW did not enter Singapore.Provided there shall be no refund if: • Any claim has been made or has arisen under the Policy; or • The premium refund is less than $27.25 (inclusive of GST). Please refer to General Conditions point 19 of the policy wording for the full cancellation terms and conditions.

Yes, we offer it as an optional add-on that covers outpatient medical expenses for illness that does not require hospitalisation. This benefit can cover up to $60 per visit, helping to ensure your FDW’s health needs are taken care of without added financial strain.

The coverage period for our Enhanced MaidAssure is 14 months or 26 months with the additional 2 months included as mandated by the Ministry of Manpower (MOM) in case the FDW overstays in Singapore after her work permit expires.

We do not cover usage for food, parcel or other delivery services.

You will only need to report to the police under the following circumstances:Damage to Government vehicle or propertyAccident with a foreign registered vehicleA Hit and Run accidentVehicle is stolen or vandalisedVehicle caught fireAccident involving a Pedestrian, Cyclist or Personal Mobility Device (PMD) usersA Malaysian police report is required if the accident happened in Malaysia.

It is advisable to make a claim on your own insurance policy. Making a claim against motorists from another country can turn out to be costly and time-consuming. If you are not at fault, your NCD will not be affected.

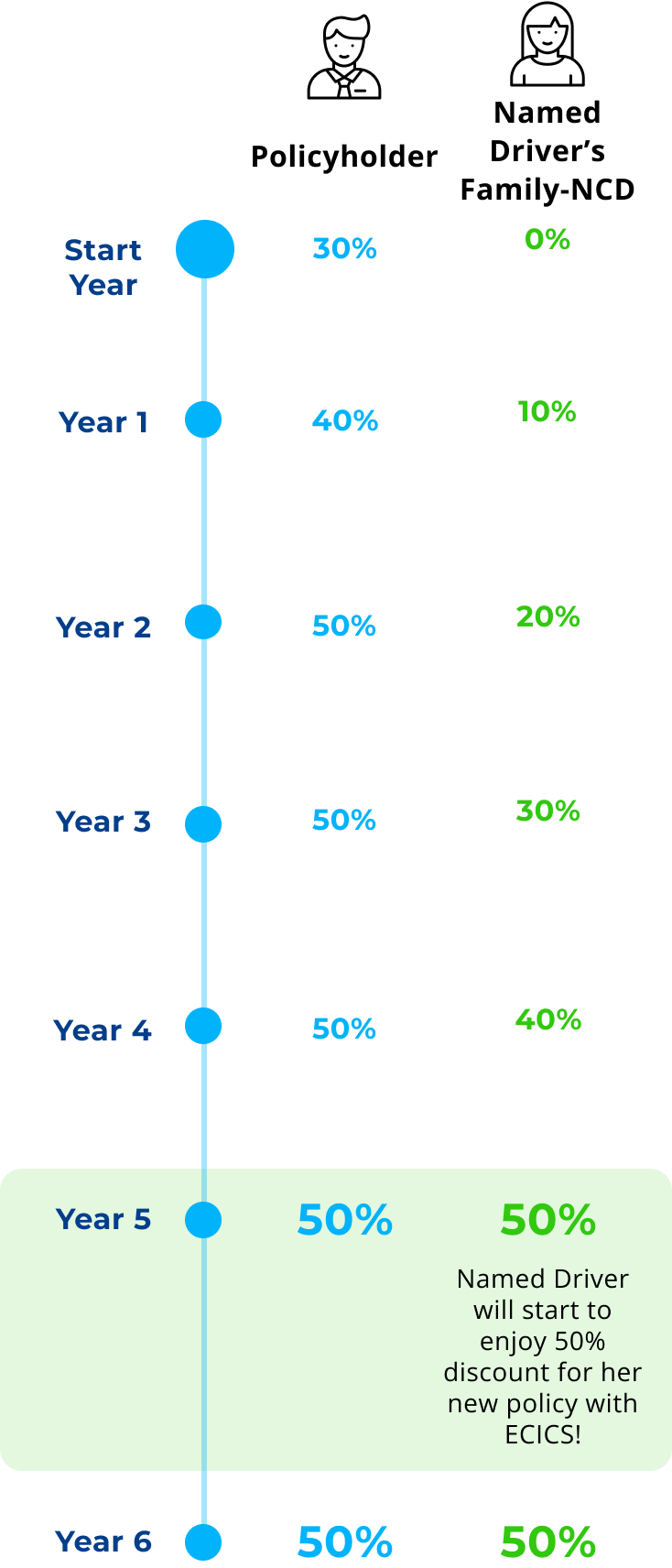

Just simply select our Comprehensive Family NCD Builder Plan during purchase and add your family members as named drivers.

A No Claim Discount Protector protects your NCD on renewal and allows you to make a claim under your policy without affecting your NCD. Without it, your NCD will be reduced should a claim be made under your policy.

Please declare all claims (excluding windscreen claims) made against your private car insurance during the past 3 years.