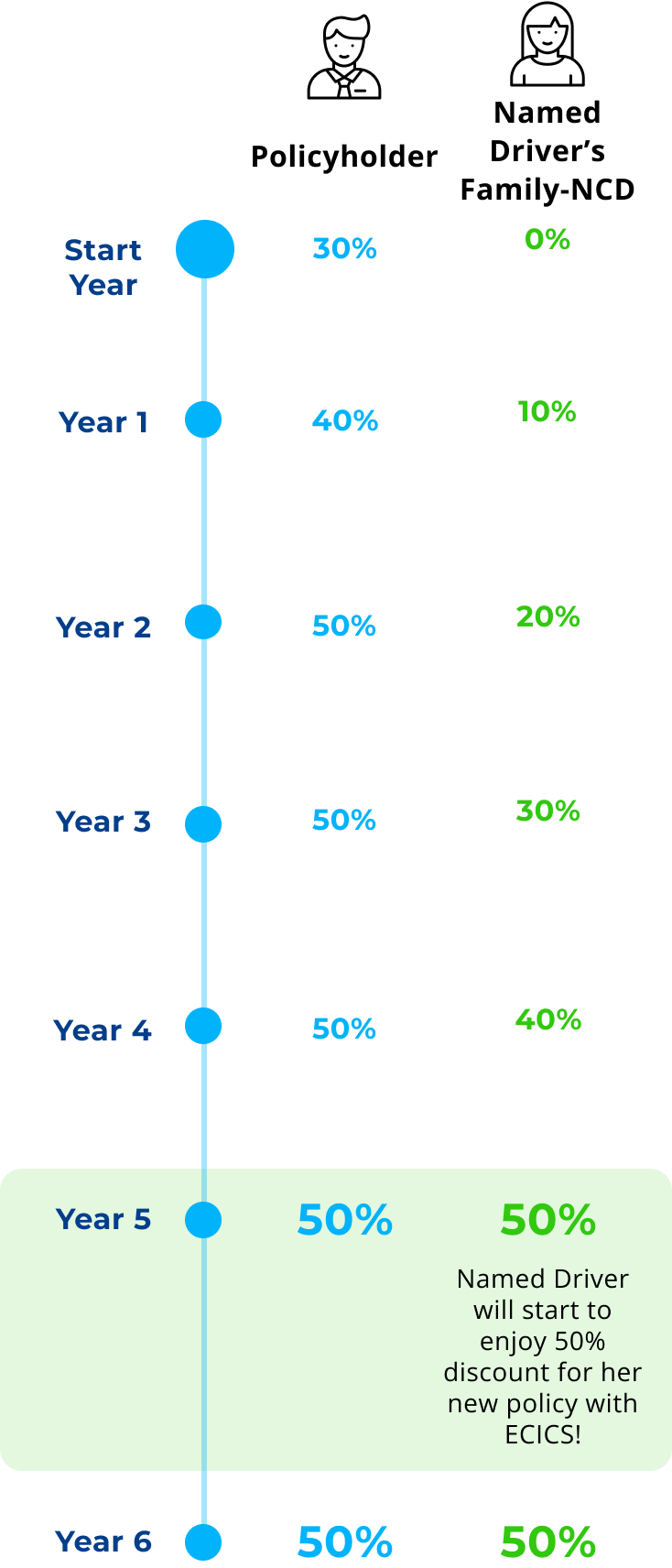

Every named driver earn 10% Family-NCD (up to 50%) for each year of safe driving as a family without any accidents - even if they don't own a car.

When your family member buys their own car, their accumulated Family-NCD can be used to reduce their insurance premium with ECICS.

Includes personal accident coverage up to $80,000 for your family members, child seat protection up to $300, and car key replacement cover up to $300.

Get 24/7 roadside assistance, and up to 10 days courtesy car while your vehicle is being repaired.

Terms and conditions apply. Discount is automatically applied. Not stackable with other promos.

1. Tesla Motor Insurance policy purchased from ECICS must be issued, in-force, and fully paid. 2. A unique email link will be sent to your registered email address under the subject titled "Tesla Motor Insurance Fractional Shares Campaign (FSPROMO)" for the redemption of Tesla Fractional Shares. Further instructions can be found on the POEMS website after clicking the link. 3. Upon completion of the steps on the POEMS landing page, Tesla Fractional Shares will be deposited into your account within 3 to 4 months following the reconciliation process.

Inform ECICS immediately and we will endorse your policy. Coverage for the new vehicle will commence after a 14-day waiting period from the date of notification.

If you or your foreign worker breaches any of MOM’s rules or conditions, MOM may forfeit the bond and demand for payment from ECICS. ECICS will pay $5,000 to MOM on your behalf and in such cases, we will seek recovery of the amount from you.

Yes, your motor insurance claims history over the past 3 years will be taken into account and may affect your premium when you apply.

Yes, ECICS Motor Excess Protector Insurance extends to cover your rental excess when you rent a car and drive overseas anywhere in the world.

MOM will issue the discharge letter 1 week after the FDW has left Singapore. Please provide us with a copy of the discharge letter to proceed with your cancellation.Please note that the effective date of insurance cancellation will be determined based on the discharge date from MOM, not the date when the work permit is cancelled.

New and transfer maid policies purchased:• within 14 days before the effective date,MOM’s record will be updated within 3 working days after the policy purchase date• more than 14 days before effective date,MOM’s record will be updated within 14 days before policy start dateRenewal maid policy:• MOM’s record will be updated within 3 working days after the policy purchase date.Please check the MOM portal and ensure that the electronic transmission to MOM is completed before your FDW arrives in Singapore. Failure to do so will result in the Immigration and Checkpoints Authority denying her entry, and she will be sent back to her home country.

Yes, the policy will need to be cancelled, and a replacement policy issued.

The eligibility criteria states that the insured FDW must be between 23 and 60 years old at the time of application. This means that individuals outside of this age range may not qualify for coverage under the insurance policy.

You will need to cancel her work permit to stop your levy and ensure that you keep a copy of her travel ticket or departure itinerary as proof. MOM will proceed to discharge the Security Bond after verifying that your FDW has left and did not re-enter Singapore. Upon discharge, you may proceed to request for policy cancellation.

Our policy covers you when you ride your motorcycle in West Malaysia, the Republic of Singapore and that part of Thailand within 80.5km of the border between Thailand and West Malaysia.

We have 3 plans to suit your needs. The Comprehensive plan covers loss or damage to your motorcycle, as well as third party liability for bodily injury and property damage.

Yes, ECICS motorcycle insurance policy comes with complimentary No Claim Discount Protector. It is free for our customers as long as you have NCD 10% and above.

Yes, it is illegal to use a vehicle in Singapore without a valid insurance cover. At a minimum, you must have third-party insurance, which covers injury or damage caused to other people and their property.

All riders need to be named in the policy. Unnamed riders are not covered.

You may call our 24-hour helpline at +65 6206 5588 (option 9) to have your vehicle towed or alternatively you may call our Authorised Workshops in the list.

The premium of your car insurance policy is calculated based on the profiles of all the declared drivers including the named driver(s). Depending on the risk profiles of the drivers, the premium may remain the same, increase or decrease.

The accident report will provide us with the necessary information should there be any claims made against you for the accident. Failure to report the accident may result in you handling and settling any claims on your own.

Unnamed Driver refers to someone who is not named under a private car policy.

It is not transferrable to other insurers. This is a unique and innovative feature of our product to provide customers and their loved ones the best value they can get.